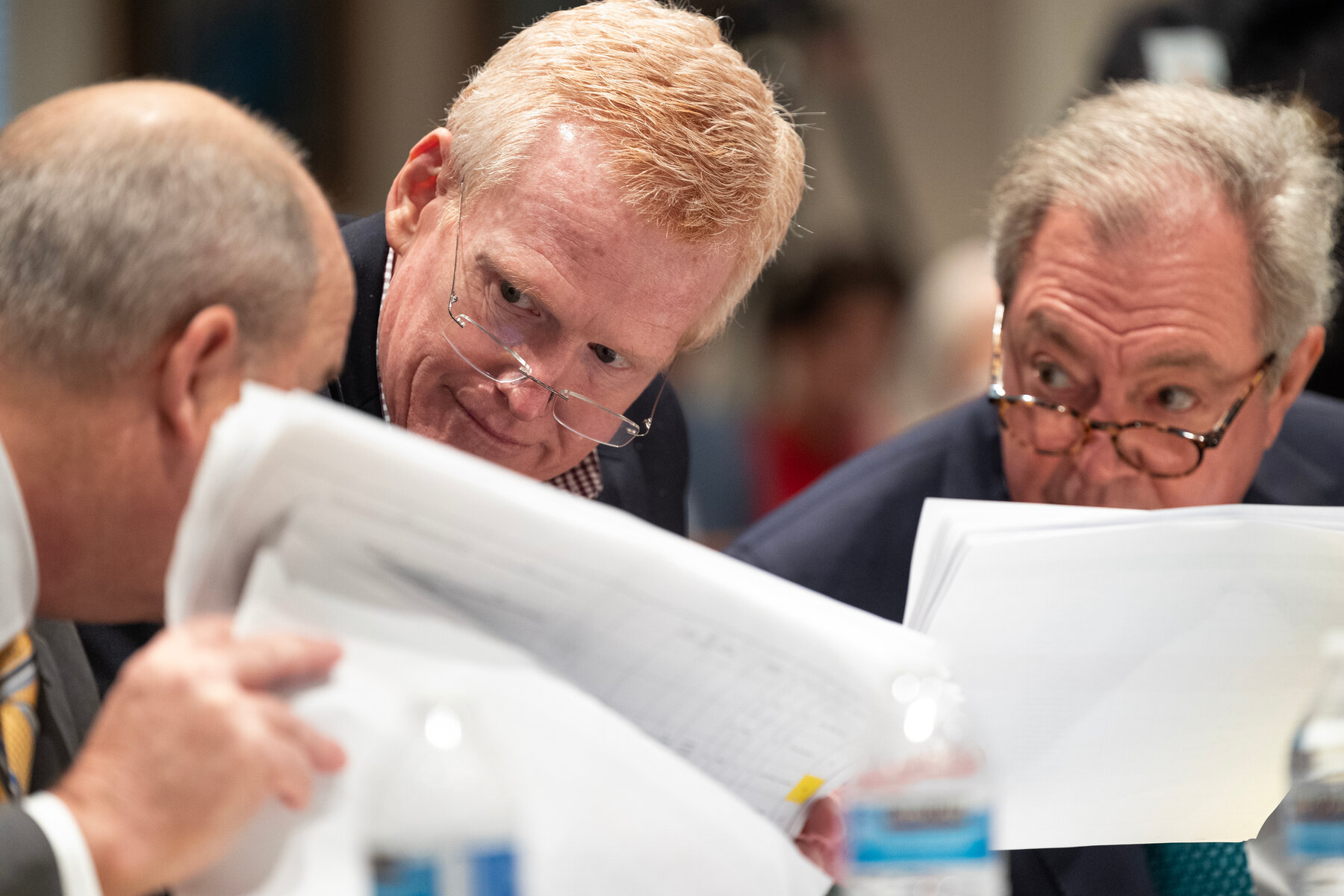

Three weeks into disgraced South Carolina attorney Alex Murdaugh’s double murder trial, prosecutors have called dozens of witnesses offering wide-ranging — and sometimes disjointed — testimony.

Jurors have heard from the investigators who found the bodies of Murdaugh’s wife and son, and technicians who found gunshot residue, cracked open cellphones to get videos and tested dozens of ammunition casings.

They’ve heard from betrayed law firm employees, heartbroken friends of Murdaugh and his family, and a man whose insurance settlement was stolen after his mother, the Murdaughs’ housekeeper, died in a fall at their home.

But witnesses have been called in disorganized groups and tantalizing scraps of evidence have been introduced but not explained. The defense hopes to start its case in middle of next week and had planned a week of testimony but is rethinking that because of the trial’s length.

Murdaugh, 54, is charged with murder in the deaths of 52-year-old Maggie, shot several times with a rifle, and their 22-year-old son, Paul, shot twice with a shotgun at kennels near their Colleton County home on June 7, 2021. He faces 30 years to life in prison if convicted.

The disbarred lawyer also faces about 100 other charges ranging from stealing money from clients to running a drug and money laundering ring.

Much of the week’s testimony focused on whether Murdaugh stole money from his family’s law firm and clients. Prosecutors contend Murdaugh thought he was about to get caught stealing and killed his wife and son to buy time to cover up the money trail.

The office manager from the family law firm said Murdaugh stole millions in fees and client settlements. A law school buddy said Murdaugh took advantage of his trust and left him to pay $192,000 to keep his client trust fund balanced. The son of the Murdaughs’ housekeeper and nanny who died in a fall testified Murdaugh promised to get them a hefty insurance settlement for the death but kept more than $4 million collected for himself.

The defense objected to each witness, saying there was no evidence linking the killings to financial misdeeds.

“This is piling on. This is more trying to prejudice the jury into believing somehow someone who steals a bunch of money in any way whatever would commit a murder,” Murdaugh lawyer Dick Harpootlian said.

DISJOINTED CASE

Prosecutors have called 47 witnesses in 12 days of testimony, but at times there has been little rhythm to the order.

This week, the caretaker of Murdaugh’s mother testified about a blue jacket Murdaugh might have held when he visited but then other witnesses testified about financial crimes before the state forensic scientist who tested the jacket for blood and gunshot residue took the stand.

Long, tedious testimony has focused on cellphone data between Paul Murdaugh’s friends.

Some intriguing evidence has been introduced but never explained to jurors, who do not have notebooks to keep track of testimony.

A crime scene technician put into evidence a receipt with a $1,021.10 item from Gucci circled, but it hasn’t been brought up since. An FBI technician gave the times Murdaugh’s SUV was shifted into and out of park the night of the killings without interpretation.

Sports1 year ago

Sports1 year ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

Entertainment1 year ago

Entertainment1 year ago

Florida2 years ago

Florida2 years ago

Entertainment2 years ago

Entertainment2 years ago

Tech2 years ago

Tech2 years ago

Business2 years ago

Business2 years ago